Company Profile

Since its establishment in 1983, Advantech has focused on the global IIoT field, providing corporate customers with a full range of services such as software and hardware system integration, customized design services, and global technical support. And the vision of the corporate brand of “Enabling an intelligent planet”.

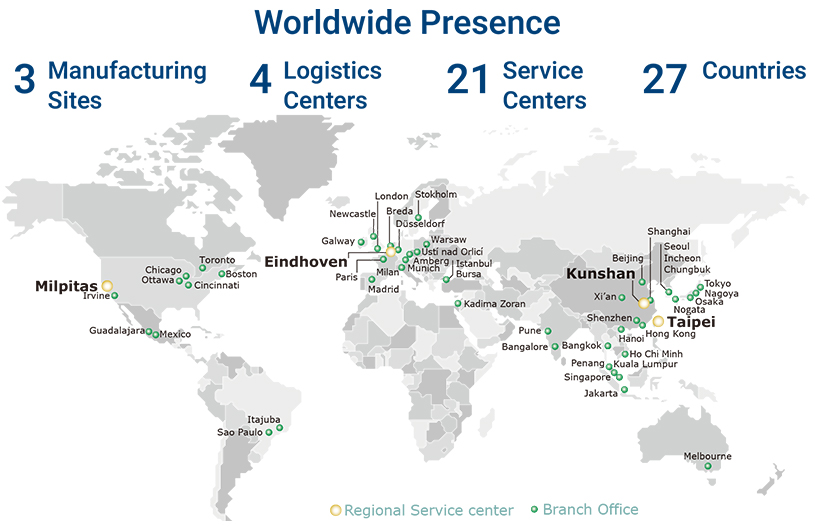

Advantech is a Taiwan listed company and has been listed on the Taiwan Stock Exchange since 1999 (TWSE: 2395); Headquartered in Neihu Science Park, Taipei, Taiwan, our business base spans 27 countries in Europe, America, Asia, and other regions. Our three major manufacturing centers are located in Linkou (Taiwan), Kunshan (China), and Fukuoka (Japan). Furthermore, we have built four logistics management centers and 21 local service centers to provide global customers with real-time and comprehensive integrated services via a complete service system.

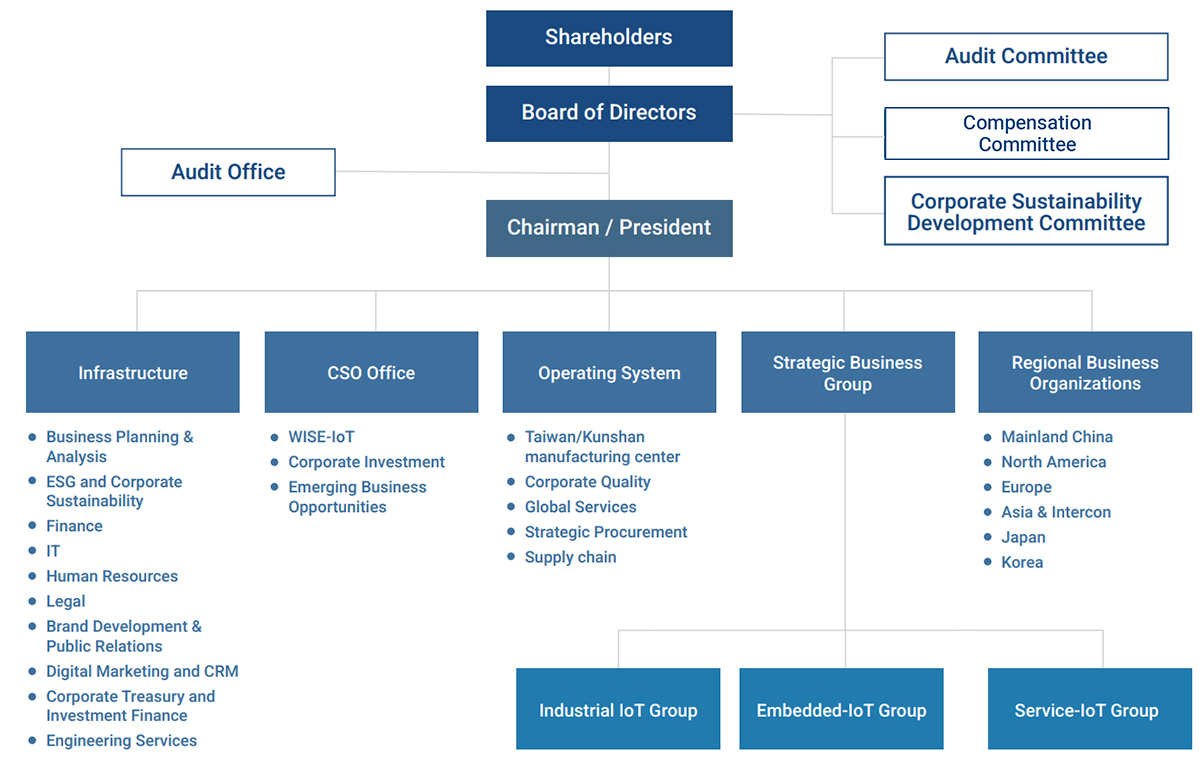

Advantech and its affiliates specialize in the manufacturing, assembly, sales, and after-sales service of industrial computer related products (details in Organization Chart). Its main business groups include: the four major business sectors: Embedded Sector, Intelligent System Sector, IoT Automation Sector, and Intelligent Services Sector. The Company focuses on five major key markets including Edge Intelligent Systems, Smart Manufacturing, Energy and Utilities, Intelligent Healthcare, and Intelligent Retail and Services, providing diverse application solutions to meet the needs of customers across various industries. Embracing the trend of Edge Computing and Artificial Intelligence (AI), Advantech will focus its strategy on Edge Computing and Edge AI to bolster its global presence and enhance core competitiveness. By integrating our Edge Computing hardware platform products and the industrial IoT software platform WISE-IoT, with industry Edge AI solutions and industry knowledge, we will shift towards a co-creation-centered business model for integrated industry applications, helping our partners and customers to connect within the industry chain. Furthermore, we work closely with partners across different industries to "co-create" industry ecosystems, aiming to accelerate the realization of industrial intelligence.

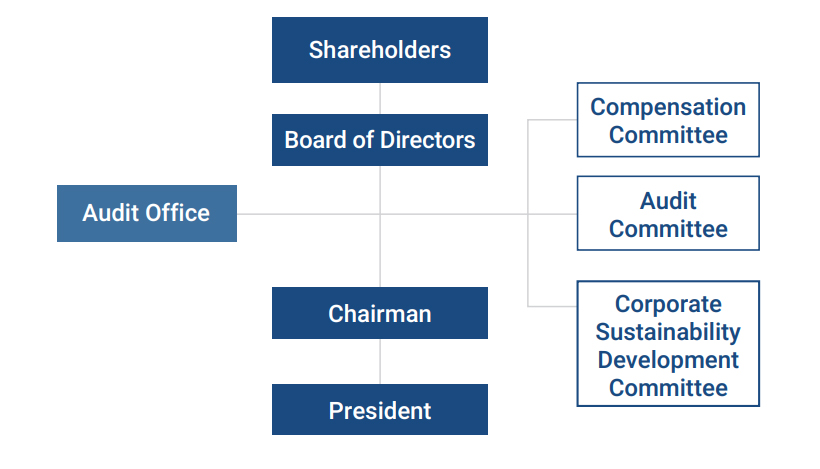

Organization Chart of Advantech

The industries that Advantech and its affiliated companies work on are mainly in the manufacture, assembly, sales and after-sales service of industrial computerrelated products. Some affiliated companies invest in related technologies and business activities connected to the aforementioned products to form their business scopes. The organization chart of the Company is shown in Figure.

Distribution of Advantech’s Operating Locations

Management Performance and Brand Value

In 2024, Advantech's consolidated revenue declined by 7% year-on-year due to systemic factors such as global high inflation, geopolitics, and the U.S. Presidential election. While the gross profit margin saw a slight increase compared to the same period last year, both the operating and net profit margins declined due to the slowdown in revenue performance. The EPS for 2024 was NTD10.45

Advantech has long remained focused on its core business while building a strong financial foundation. The Company maintains a high dividend payout policy to share business results with shareholders. In 2024, a total cash dividend of NTD 8.4 was distributed, representing a payout ratio of over 80%, reflecting Advantech's commitment to delivering greater shareholder value. For the historical financial performance please refer to the Company's official website. Since its founding, Advantech has focused on building its own brand. In 2024, with a brand value of USD 851 million, Advantech was awarded 5th place in Branding Taiwan, and has steadily remained in the top 5 of Branding Taiwan for seven straight years.

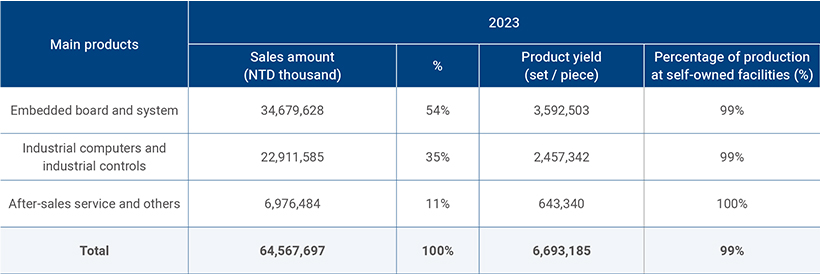

Advantech's Products, Revenue Distributions and Product Output in 2024

* Note:

The area of production plants is as follows: Manufacturing Center in Linkou, Taiwan (553,030 ft²); Manufacturing Center in Kunshan, China (1,107,821 ft²); Manufacturing Center in Fukuoka, Japan (162,902 ft²)

Corporate Governance

An evaluation was conducted by Interbrand, an internationally renowned brand evaluation agency commissioned by the Industrial Development Bureau of the Ministry of Economic Affairs.

Please refer to the website: Internal Audit, Advantech Code of Ethics and Business Conduct , Guideline for Insider Trading revention Management、Article of Incorporation

Composition and Operation of the Board of Directors

Advantech is committed to enhancing the effectiveness of its Board of Directors and has implemented a comprehensive director selection system. Board member appointments adhere to a diversity policy,with evaluations encompassing industry background, professional expertise, age, and gender balance to foster a broad range of perspectives. In addition to considering international market outlook, professional and academic achievements, and risk management capabilities, Advantech also plans to incorporate sustainability expertise into the evaluation criteria for Board members. The selection of director candidates follows the candidate nomination system under "Article 192-1 of the Company Act", and are elected by the shareholders' meeting from the list of candidates; independent directors are recruited in accordance with the "Regulations Governing Appointment of Independent Directors and Compliance Matters for Public Companies. In addition, according to the Company Act, the Board of Directors shall execute its duties in accordance with applicable laws and regulations, the Articles of Incorporation, and resolutions of the shareholders' meeting. Should any resolution result in damage to the company due to violation of such provisions, the directors participating in the resolution may be held liable for compensation. However, those who expressed dissent and had it recorded in the meeting minutes shall be exempt from such liability. Advantech also procures Directors and Officers Liability Insurance (D&O Insurance) for all board members annually. For further details regarding the D&O Insurance policy, please refer to page 49 of the 2024 annual report.

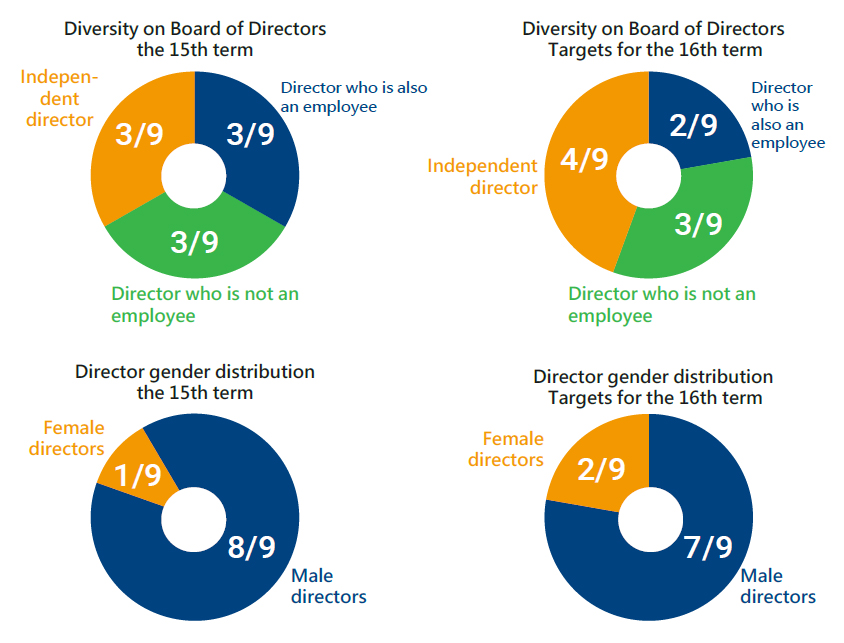

Advantech is currently in its 15th term of Board of Directors, consisting of nine members. The current board term spans from May 25, 2023, to May 24, 2026. The composition of the current Board of Directors and the developmental goals for the upcoming 16th term are illustrated in the figure below. One Board seat will be designated to the Advantech Cultural and Educational Foundation, ensuring representation of public welfare stakeholders in the Board's composition. Overall, the composition of Advantech's Board of Directors complies with the principle of diversity. The directors' diverse professional perspectives are constructive and beneficial to the Company's ability to cope with operational, industry, and sustainability impacts. The average tenure of the 15th Board of Directors as of the end of December 2024 was 9.8 years.

Mechanism of Progressive Sustainable Development Committee (SDC)

In July 2022, Advantech officially established the Sustainable Development Committee (SDC) at the board level to hold meetings quarterly to formulate the Company's long-term development strategy. Among them, the Q1 / Q3 SDC meeting is positioned as an "Expanded SDC", inviting all directors, external experts, consultants, and senior management on an expanded basis to discuss in-depth Advantech's business model innovation, business inheritance, medium and longterm vision, and other key development issues. In 2024, two expanded SDCs were convened. Discussion topics included the corporate operating structure and transition towards a Sector Driven model, which involves reforming the past business model centered on "products”, completely shifting to an "industry” focused approach, concentrating on industry-specific vertical markets, consolidating internal resources, targeting pioneering industries, and driving product innovation in response to industry demand. Guided by the diverse professional insights of external consultant teams and Sustainable Development Committee members, Advantech is streamlining its global organization, forming a talent pipeline and expert industry teams, in a bid to promote the long-term transformation of its corporate operating structure. Other topics discussed included the optimization of internal corporate management systems and talent training; revitalization of financial and investment issues including M&A; key AI industry technologies and trends; strategic topics such as Emerging Business Department development; and policies on compensation structures and incentive systems. This mechanism enables the broad integration of opinions from external consultants, fosters internal consensus, and drives reform, embodying the power of collective intelligence and execution.

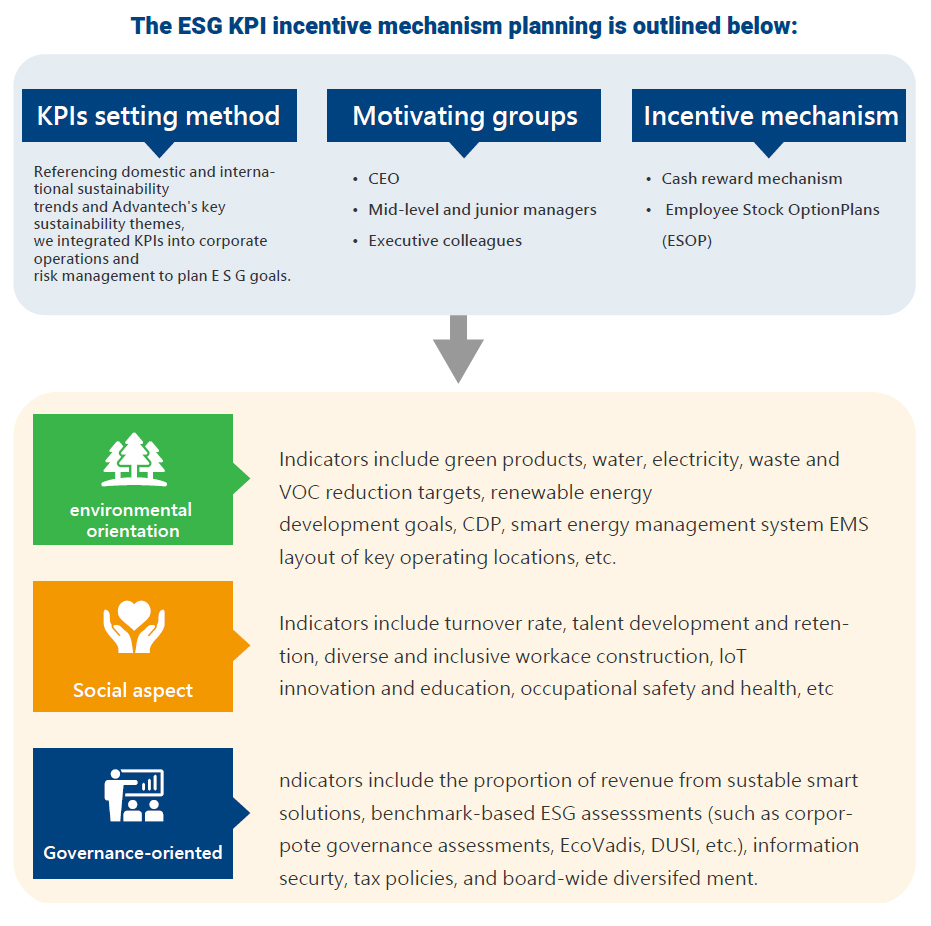

ESG Performance and Incentive Mechanism

Advantech has continued to advance its vision of "Enable an Intelligent and Sustainable Planet". In 2022, they established and implemented an ESG KPI mechanism for senior executives, including the Chairman, Co-Governance President, senior management, responsible managers, members of the ESG Corporate Sustainability Development Office, and other accountable colleagues. This mechanism includes ESG sustainability indicators such as environmental, social, and governance aspects. Major performance evaluation items for 2024 are planned. The incentives and remuneration are mainly based on Employee Stock Option Plans (ESOPs) supplemented by performance bonuses. The calculation period is Q1 of each year, with distribution taking place in Q2 and Q3. At the same time, goals and promotion plans are set and regularly evaluated by benchmarking domestic and international sustainability trends, Advantech's operations and risk management mechanisms. Payments are made based on sustainable goals, quantitative indicators, and actual performance. In 2024, as part of the execution results, Advantech awarded over 14,000 shares and over NTD 3.4 million in cash incentives to senior management, junior and middle management, and frontline staff for their excellent ESG performance.

Tax Policy

Advantech holds the Lita spirit, a concept of altruism within the company, and expects to give back to society while growing the business. Therefore, we take it as our responsibility to contribute reasonable taxes to societies and economies where we conduct our business. We seek to comply with relevant tax laws and regulations but do not seek to conduct aggressive tax planning. According to Advantech Tax Policy, headquarters and its subsidiaries should abide by the following principles:

- Act at all times in compliance with the spirit and the letter of the relevant tax laws and regulations in the countries in which we operate.

- Advantech complies with Organization for Economic Cooperation and Development (OECD) Transfer Pricing Guidelines to prepare three-tier transfer pricing documentation.

- Transfer pricing is set based on the “arm’s length principle.” Profits from each operating entity are reasonably remunerated for the risk and complexity of each entity’s activities.

- Advantech’s major decisions are made mainly based on business purposes, and then supplemented by tax analysis to search for optimal solutions.

- Do not engage in any arrangement that transfers value created to low tax jurisdictions or tax havens simply for reducing tax burden. Do not use tax havens or tax structures whose sole purpose is for tax avoidance.

- Assess tax risk periodically and reduce it by negotiating Advance Pricing Agreement (APA) with local tax authorities in the countries Advantech generates high income.

- Build mutually respectful relations with tax authorities based on mutual trust and communication, information transparency, and tax payment with integrity.

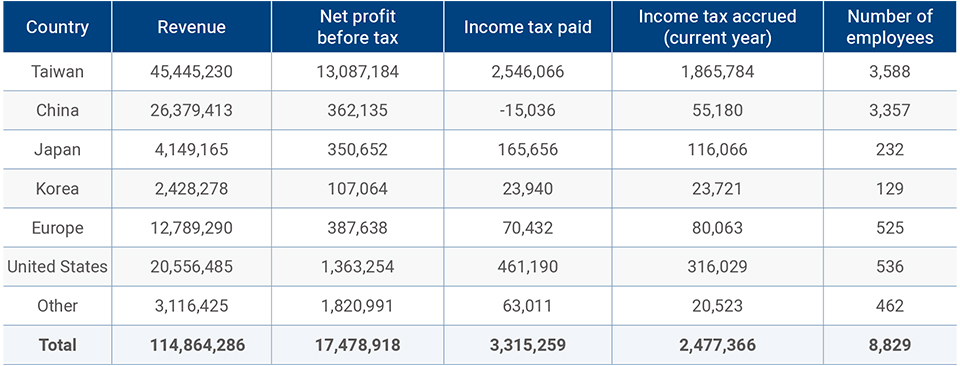

2024 Revenue, net profit before tax, tax information, and number of employees (Unit: NTD thousand)

* Note:

1. The revenue, net profit before tax, and tax information are aggregated amounts from local entities' statutory financial statements and related party transactions are not excluded.

2. The net profit before tax includes investment gain (loss) accounted using the equity method.

3. For the names of all resident entities and their primary business activities, please refer to the appendix of Advantech Co., Ltd.'s 2024 Sustainability Report.

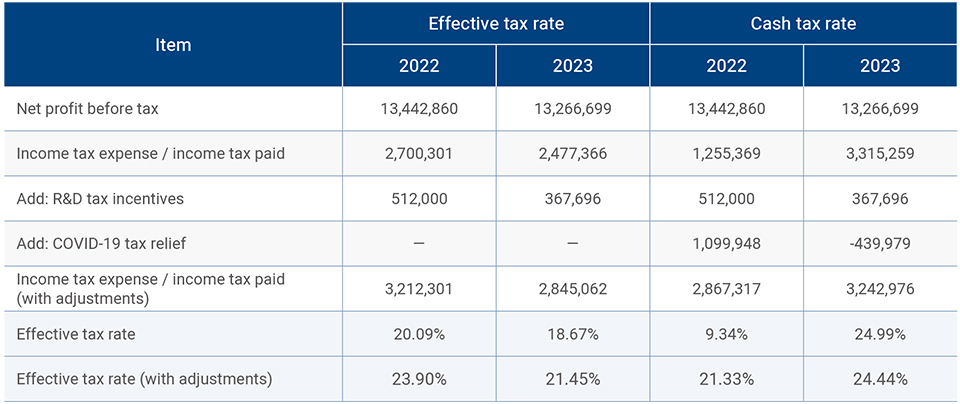

The Group‘s effective tax rate and cash tax rate for 2023 and 2024 are as follows:

Source: pages 10 of the 2024 Advantech Co., Ltd. Consolidated Financial Statements; please refer to the "Consolidated Statements of Cash Flows" on page 13 for income tax payments.

1. Effective tax rate = Income tax expense ÷ net profit before tax

2. Cash tax rate = Income tax paid ÷ net profit before tax

3. Advantech's effective tax rate and cash tax rate for 2024 were 19.01% and 36.34%, respectively, while the average effective tax rate and cash tax rate over the past two years were 18.83% and 30.13%, respectively. Both rates are higher than the 2024 S&P Global CSA Handbook's average effective tax rate (15.39%) and cash tax rate (15.09%) for the "Technology Hardware & Equipment" industry group.

Taxation Governance

Advantech is subject to tax laws and regulations in the various jurisdictions in which it operates or conducts business. Changes in tax laws and regulations will increase tax liabilities and compliance burdens, which will have an adverse impact on business operation. In order to effectively manage tax risks, Advantech complies with the tax laws and regulations; understands the tax liability and compliance status; identifies potential tax risks; prioritizes the issues and handles them on case-by-case basis. Technology tools are also been used for effective tax management. Aforementioned tasks and results are regularly reviewed by the management. The strategy development of global finance and tax is led by the management, who delegates day-to-day responsibility to headquarters finance manager. Local accounting teams execute the tax filings complying with tax laws and regulations. In addition, Advantech also engaged external tax consultants and CPA firms for tax reporting and compliance services. Advantech's Audit and Risks Committee is delegated by the Board to oversee the quality and integrity of the accounting, auditing, and financial control practices of Advantech through periodic review of certain major matters, including accounting policies and procedures, internal controls systems, legal compliance, and corporate risk management, etc. Advantech's Tax Policy is reviewed in the Audit and Risks Committee and approved by the Board.

Integrity Management: Compliance with Laws and Regulations, Anti-Corruption and Anti-Competition

Integrity management is an important part of the internal control mechanism of corporate governance. Advantech identifies various laws and regulations in advance, and then communicates with relevant internal units to evaluate the formulation and implementation of the Company's relevant rules, in order to ensure smooth compliance with laws and regulations and practical practices. The concepts of compliance with laws, anti-corruption, anti-competitive, and social responsibility in integrity management are closely related to the Company's goodwill, which is one of Advantech's sustainable operations.

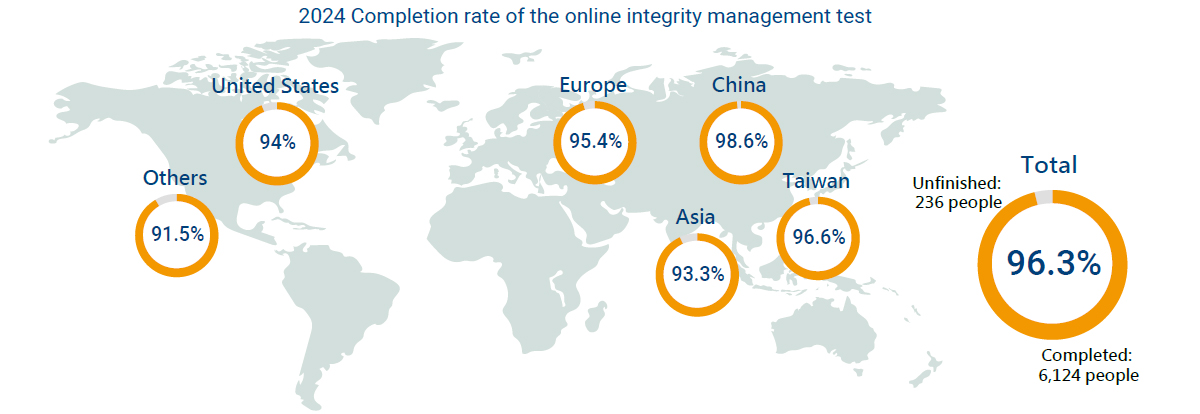

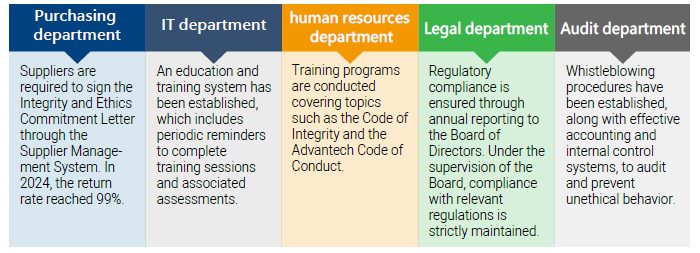

Promotion and implementation of integrity management

|

Below are Advantech's material breach of laws and regulations in 2024: *Definition of material breach of laws and regulations: Any breach of laws and regulations as per the material information listed by the Financial Supervisory Commission (Taiwan, ROC). Material breach of laws and regulations (including incidents of fines and nonmonetary sanctions) in 2024

|

|