Management Guidelines for Major Topics

| Item | Explanation |

|---|---|

| Policy or commitment | |

| Policy or commitment |

Advantech has risk management policies and business continuity plans in place, aiming to perform risk impact assessments in advance, promotion of countermeasures, and define handing processes during risk occurrences in order to reduce their possible impacts and influences when risks occur and to facilitate subsequent correction and management. Advantech strives to provide transparent and sufficient information and communication to potentially affected stakeholders regarding major risk events and countermeasures. |

| Impact description | |

| Impact description |

The risks identified in Advantech's risk management process involve economic, environmental, and social issues. If each risk item is not effectively managed and responded to, the possible negative impacts on the Company include affecting the Company's strategy execution and operational performance achievement, impair the Company's goodwill, or increase the Company's operating costs and expenses. Please refer to the individual risk item descriptions for relevant preventive or mitigation actions. On the other hand, through early identification of risk events and effective response, risks can also be transformed into future business opportunities and competitiveness. |

| 2023 Goals achievement status | |

| 2023 Goals achievement status |

|

| 2024 Goals | |

| 2024 Goals |

|

| 2025 Goals | |

| 2025 Goals |

|

| 2030 Goals | |

| 2030 Goals |

|

| Key action plans or programs | |

| Key action plans or programs |

|

| Effectiveness assessment | |

| Effectiveness assessment |

|

| Stakeholder engagement | |

| Stakeholder engagement |

Advantech conducts an annual risk survey, targeting mid-to-senior managers, directors, certified public accountants (CPA), and external consultants. The purpose of the survey is not only to identify major risk items, but also to gather opinions on risk management improvement. A risk mailbox was created to encourage and solicit all employees feedback for improving risk management. Major risks and relevant mitigation actions are fully disclosed through various channels such as the official website, sustainability reports, earnings call, and press releases, so that investors, institutional shareholder and other stakeholders can fully understand. |

Risk Foresight and Crisis Management

Advantech defines various risks based on the Company's overall operational direction, and implements an enterprise risk management mechanism (ERM) to establish, identify, precisely assess, effectively supervise, and strictly control risk management mechanism. Prevent possible losses within the risk appetite and continuously adjust the best risk management practices according to the changes in the internal and external environment. Major risks identified through Advantech's risk management process include economic, environmental, and social issues. Economic issues include business succession, management of overseas business subsidiaries, sustainable supply chains, information and cyber security, and cross-border tax issues. Environmental issues include low-carbon and eco products, climate transition risks, etc.; social issues include talent cultivation and retention, labor relations, personal data protection, etc.; the results of the annual survey on significant sustainability issues are also used to identify and assess major risk issues each year. Taking 2023 as an example, material sustainability issues were also considered as the main strategic or operational risk issues in enterprise risk management, for the proportion of up to 70%.

Advantech uses the risk management mechanisms to reduce or mitigate the potential impact of risks on the Company's revenue, costs, and reputation; at the same time, we proactively explore opportunities that may arise from risks, such as investing in solar energy, wind power, and electric vehicle-related applications, and developing energy management platforms that can be applied to different industries.

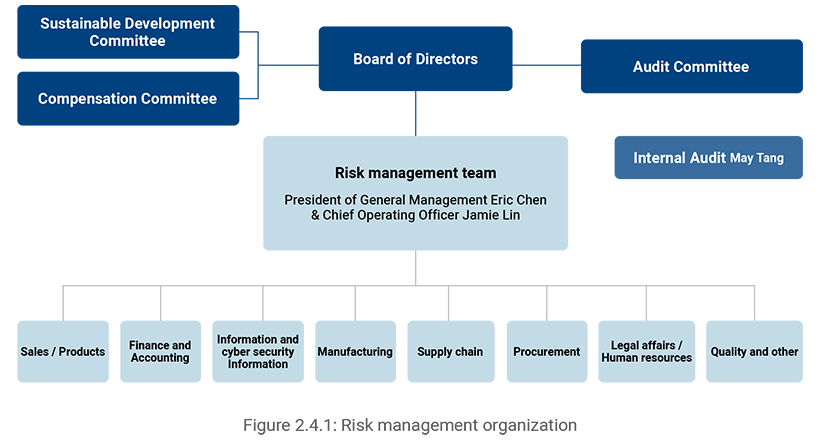

Risk Management Organization

As the highest governance unit for risk management, the Board of Directors oversees the overall risk management mechanism and approves the revision of policy and procedure. The Board of Directors, Sustainable Development Committee, and Compensation Committee are responsible for the supervision and tracking of pan strategy risk items and risks with a diverse or global impact, while pan operational risks are mainly supervised and by the Audit Committee.

The risk management team is the highest management unit for operational risk management. It is responsible for implementing the risk management process and reviewing progress of risk mitigation actions implementation status quarterly. The responsible managers of each function are responsible for formulating risk mitigation actions and actual implementation. The internal audit team closely supervises or even assists in the execution of all risk management processes and provides opinions. It also conducts audits of various risk topics as needed. Basically, major risks that will be prioritized and included in the annual project audit. The proposal for the evolution of the risk management mechanism is also proposed by the risk management group and the internal audit after joint discussion.

The risk survey and identification process is initiated by the risk management team in the fourth quarter of each year, and the measurement and response plans for major risks are completed at the beginning of the following year. Due to the rapid changes in the business environment, the risk management team and the management flexibly observe and propose changes in various risks that require attention. Add or adjust the identification and measurement of risk items and mitigation plans, and include them in the discussion and tracking of quarterly risk management meetings or senior management meetings.

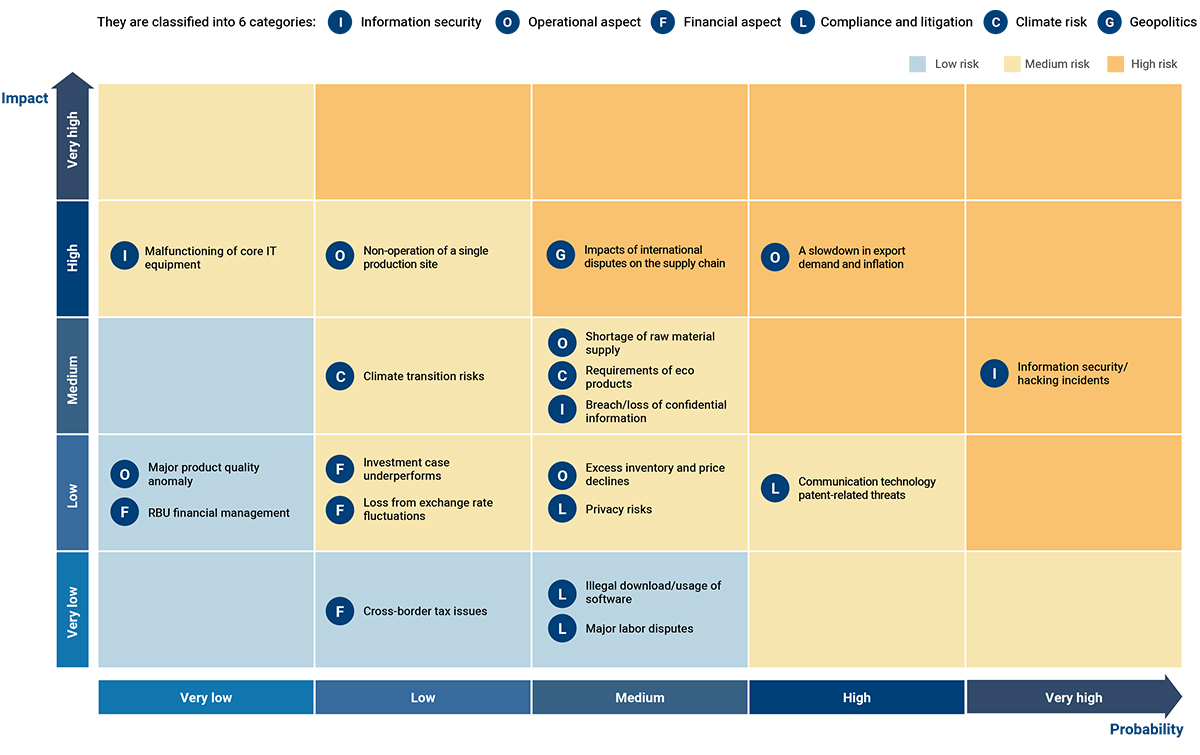

Advantech Operational Risk Map

The high and medium risk areas highlighted in orange on the risk map has exceeded the Company’s tolerable risk appetite, and it is necessary to adopt risk adjustment strategies and countermeasures as a priority to reduce the likelihood of occurrence or the level of potential impact, and the improvement results are closely monitored.

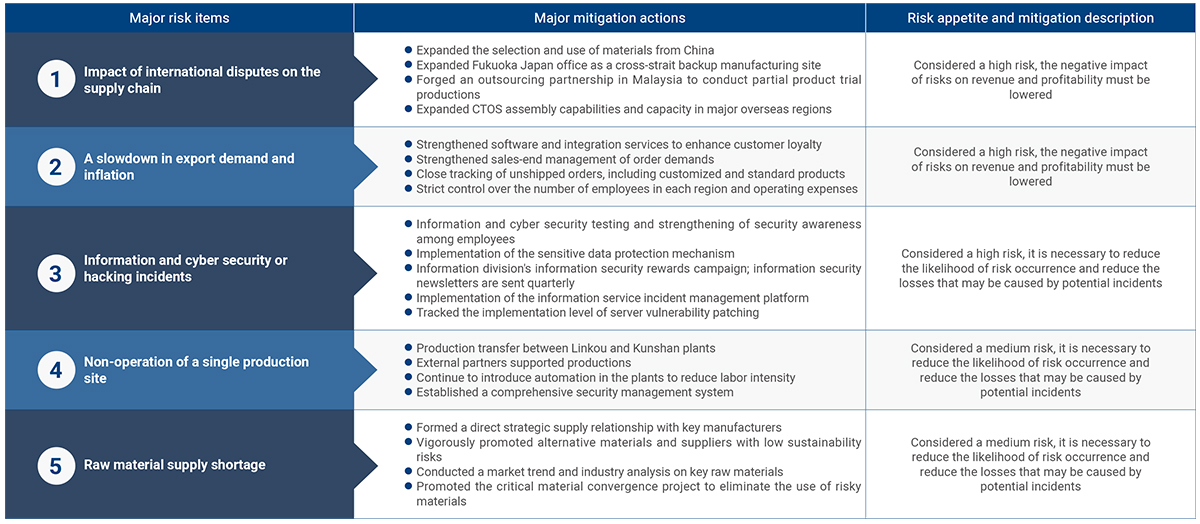

Mitigation actions to Major Risks and Risk Appetite